Introduction

Banking is a very sensitive yet challenging business. It is

not only about doing business but also about emerging itself as a safeguard of

public money and valuables. In the process to perform its duties and safeguard public money, the bank has to function effectively and in a well-controlled manner.

Such an effective and controlled manner to perform duties is possible through the identification

of risks and their effective management. Risk is usually referred to as

the potential financial or non-financial loss that the bank can suffer due

to the happening of certain adverse events. Banks can face major risks like the risk

of financial loss, risk of bad customer onboarding, risk of regulatory

non-compliance, risk of liquidity shortage, risk of bad credit disbursement,

risk of external fraud, risk of capital insufficiency, etc.

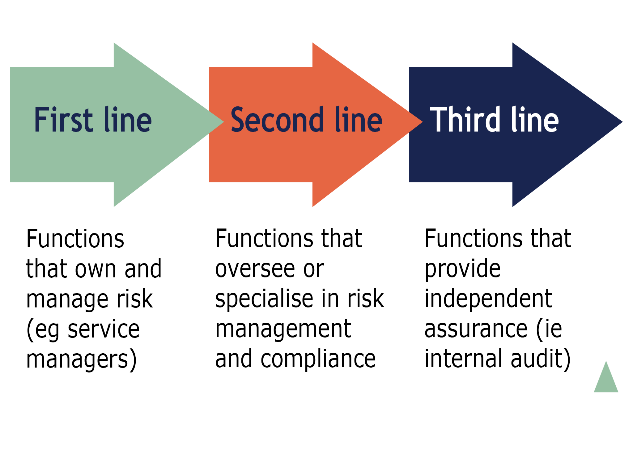

Lines of Defense

Bank has three lines of defense, the first line are the business

verticals, the second line is the Risk and Compliance verticals and the third line is

the Internal Audit. These three verticals should function parallelly for the bank’s

growth. The primary responsibility to manage risk is that of the business verticals

itself as they are the first line to defend against risks, after the first line comes, the Risk

and Compliance department which is the second line to defend the risk. And

finally, there is an internal audit which acts as a last line to check,

correct, suggest, and manage the risk as the third line of defense.

Types of Risk

To understand risk management, we need to first

understand the major risks that the bank can face. Here is the list of major

risks to which the bank is exposed:

1.

Credit Risk

2.

Operation Risk

3.

Market and Liquidity Risk

4.

IT /Digital Risk

Risk Management

Risk Management is the process of managing the risk

prevailing across the bank functions and implementing adequate controls to keep

such risk at an acceptable level. Risk Management is often referred to as a proactive measure adopted by a bank to safeguard its business. The Risk

management philosophy has been emphasized in detail by NRB Directive No. 5.

a. Management of Credit Risk

Credit Risk is the risk that the credit portfolio of the bank

deteriorates. Credit risk is the risk that the loan extended by the bank is not

recovered at all. When a borrower does not comply with the agreed credit terms

at the time of disbursement including default in payment, collateral dispute

and other defaults, credit risk starts to arise. Credit Risk gives raise to an increase in NPL, default in repayment, increase in recovery actions, etc. among

others. Exposure to Credit Risk will increase the bank’s Risk Weighted Exposure

and can put stress to bank’ capital. Managing the credit risk starts from

lending decision itself, Relationship Managers at branches shall have to access

the borrowers in detail to judge whether it will trigger to credit risk or not.

Branches shall have to access cash flows of the borrower, repayment

Possible Measures to Manage Credit Risk

i.

Evaluate 5C’s prior to lending (Capacity,

Character, Capital, Collateral, Conditions).U

ii.

Understand the need of borrower and ensure that

the financial need is genuine.

iii.

Evaluate the primary source of income, alternate

source of income and obtain assurance on repayment capacity.

iv.

Monitor the cash flows of the borrower and

safeguard bank against the cash flows regulatory.

v.

Get versed with regulatory compliance and offer

the credit product in line with approved bank’s product paper guidelines.

vi.

Monitoring and setting appetite of

Non-Performing Loan, overdue loans, expired loans to keep the portfolio mix

clean and recovery actions at low level.

vii.

Monitor the loan portfolio post disbursement,

carry out AMR (Account Monitoring Report) to evaluate the performance of the

accounts.

viii.

Understand the BASEL norms on assigning the

lending wise Risk Weighted Exposure and classify the credit portfolio as per

BASEL norms.

ix.

Verify

the customer details with regulator portal like IRD, ICAN for independent

assessment.

x.

Carry out

Credit Risk Review and judge the credit portfolio status.

xi.

Evaluate

the collateral, carry out CSVR, independently assess the market rate and ensure

its acceptability to bank and salability in future.

xii.

Carry out business visit and understand the

business process, receivable cycle, collection period, stock turnover time and

other sources of cash flows.

xiii.

Evaluate the CICL report, Declaration from

borrower, internally maintained Hotlist to check the borrower eligibility/history/capacity,

collateral backup, financial capacity, character of the borrower to minimize

the credit risk upfront. Borrower’s business / income shall be assessed through

account statement maintained with us or with another BFI’s. Every staffs

involved in credit chain shall have to be well versed with regulatory provisions,

NRB directives, internal policy and circulars to effectively manage the credit

risk. NRB directive no.1, 2 and 3 contains major regulatory provision with

regard to credit flow, credit risks and other credit parameters. Bank has an

independent Risk Management Department and Credit Approval Unit for effective

management of credit risk. For sound management of credit risk bank has

formulated several policies like Credit Policy, Risk Management Policy among

others. To buffer the effect of credit risk, bank implements BASEL framework

for assigning credit risk weight on credit exposure and link it with Capital to

compute CAR. Sometimes ineffective management of credit risk can lead to bank’s

failure like that of Lehman Brothers.

b.

Management of Operation Risk

Operation Risk, is the risk that arise because of inadequate

people, failed process, failed system and insufficient controls. Operation Risk

is more related to operation and functionality of banking operations. If a bank

fails to manage its day to day operation due to failed process, system,

controls or inadequate people then it results to operation risk. The primary

responsibility to manage operations at branch is that of Service Manager. So,

branch operation risk is the more inclined towards service managers, teller

operations, CSD staffs. Unlike credit risk, operation risk does not have a risk

weight assigned based on its exposure, rather the Basic Indicator Approach is

being used to assign risk weight in operational risk. Bank’s gross income of

past three years is taken to base for computation of operational risk weight

exposure as per BASEL norms. Thus, operation risk cannot be linked one to one

basis as like under credit portfolio. Operation Risk created by people can be

because of inadequate staff, staffs with fraud mindset etc. Operation Risk

created by process can be because of inadequate/obsolete policy documents, lack

of reporting line clarity, no approval process. Operation Risk created by

system can be because of outdated systems, weak system controls etc. whereas

operation risk created by external events can be because of external fraud,

natural calamities, riots etc. For effective operational risk management bank

shall train its staffs properly, define clear hierarchy line, set updated

policy and procedures, update and implement strong IT systems, carry out DR

drills, BIA test among others.

Possible Measures to Manage Operations Risk

i.

Understand the gravity of work, process defined

by bank, while performing tasks and be proactive rather than reactive.

ii.

Read all the regulatory policy, circulars,

directives, internal policies properly and understand/implement them in day to

day function.

iii.

Take ownership of every tasks so self- performed

iv.

Read major policies like Cash and Vault

Operation Manual, Customer Service Policy etc. related to operations.

v.

Ensure strict compliance to TAT and service

delivery.

vi.

Timely incident reporting and escalation for

resolution and effective settlement.

vii.

Monitor the suspicious activity of customers,

staffs and other stakeholders.

viii.

Maintain proper documentation and records to

ensure that the record keeping is safeguarded.

ix.

Ensure onboarding of customers is properly

monitored, documents are kept intact and risk grading is done to classify the

customer.

x.

Understand AML/CFT related risks properly and

evaluate the same while reviewing the funds flow of customers.

xi.

Take the maker and checker concept seriously in

systems and ensure dual custody of keys.

xii.

Supervise the work of subordinates, Consult with

supervisor for any confusion.

c.

Management of Market and Liquidity Risk

Market and Liquidity Risk, is the risk arising from the

macro-economic factors like interest rate change, currency movement and

liquidity position among others. Management of market and liquidity risk is

more determined by external factors and movement in market conditions. Market

and liquidity risk are managed through monitoring of Capital Adequacy, Net Open

Position, Investment analysis among others. Currently bank is adopting net open

approach to define risk weighted exposure for market and liquidity risk. Banks

analyzes its market position, investment position and foreign exchange exposure

among others to effectively manage the market and liquidity risk.

Possible Measures to Manage Market and Liquidity Risk

i.

Review the investment decision of the bank and

diversity the investment portfolio according to risk appetite of the bank.

ii.

Review the foreign exchange exposure and maintain

acceptable foreign exchange exposure in line with regulatory and internal

limit.

iii.

Evaluate fluctuations in domestic and

international currency, golds, NEPSE index etc. and its possible effect on

bank’s investment decision.

iv.

Review the bank’s capital position and its

adequacy commensurate to the growth decision taken by the bank.

v.

Monitor the industry and internal liquidity

position set internal limit commensurate to the bank’s size and growth

decision.

vi.

Evaluate concentration risks and diversification

in investment decision.

vii.

Interest rate movement monitoring and evaluation

to identify the possible effect on bank’s pricing decision.

viii.

Carry out GAP analysis and bucketing of possible

bank’s assets and liabilities.

ix.

Carry out the stress testing and analyze its

effects on bank’s major ratios and indicators.

x.

Review the regulatory limits and compare with

internal limit and identify possible risk areas.

xi.

Perform Internal Capital Adequacy Assessment

Test and evaluate the sufficiency of capital.

d.

Information Technology /Digital Risk

Information

Technology (IT) /Digital Risk, is the risk arising from various Information

Technology related factors. IT risks can arise because of hardware failure,

software failure, spams, virus attacks etc. IT security is a crucial part to

bank’s business and threat to IT protocol or security can have a serious affect

to bank’s business including its day to day operations. Modern banking is

heavily dependent on information technology systems including Servers,

Networks, CBS, Security among others. These IT ecosystems are exposed to risks

and management of possible risks to these systems is IT risk management. Modern

digital banking channels like mobile banking, web banking, ATM facility which

provide remote banking access to customers are exposed to financial loss risks,

data loss risks among others. For management of IT risks, bank has a separate

Information Security Officer under Risk Management Department to effectively

look after and minimize the risks.

Possible Measures to Manage IT (Digital) Risk

i.

Keep the IT credentials safe and not to share

the self IT credentials with other persons including supervisors.

ii.

Keep the PC system, IT platforms, HR system safe

with strong password.

iii.

Lock the PC or laptop while not in use to keep

it from mishandling.

iv.

Update the antivirus and other applications of

the system/ server periodically.

v.

Review the performance of third-party

application and software periodically.

vi.

Do not click or respond to messages/ mails from

unwanted/ unverified sources.

vii.

Maintain proper and timely backups of the core

application and must needed information servers.

viii.

Carry out IT audit for independent system

assessment and control review.

ix.

Review and independently check the digital IT

systems like mobile banking, web banking, IPS etc. and its gateway for its

effectiveness.

x.

Raise

awareness among customers for minimizing IT risks.

Is Risk Management Necessary?

Now, the question arise, is risk management really necessary

in banks. The answer is obvious; risk is inherent to bank’s business. After

discussing above risk areas, it can be concluded that as the bank’s business

grows the need of risk management is equally important.

Just take an example, if a customer arrives to your bank to

deposit Rs.1,000 and another customer arrives to your bank to deposit

Rs.9,00,000; the service delivery will definitely change. For a bank, deposit

of Rs.9,00,000 will make branch more liquid; yet the deposit of Rs.9,00,000

takes more precautions, more compliance requirement, requires double cash

counting, requires double the hassle as compared to that of Rs.1,000.

As in this example, as the business grows, more the

activeness and precautions shall be taken, so more than business more is the

requirement of prudent risk management.

Summary

As there is saying that no risk-no gain, Bank has to realize

that risk is inherent to business. To grow further, bank must have adequate

strategy ahead to manage the risk and shall have effective controls in place to

keep the risk at tolerable and acceptable limit.

Bank also sets risk appetite and risk tolerance limit based

on the its growth and nature cycle. Thus, as the bank’s business grows there is

an equal need of effective risk management. Bank shall equally emphasis on

growing the business and keeping its risk at tolerable limit as part for is

sustainable and long-term growth.